Nice Info About How To Reduce Gearing Ratio

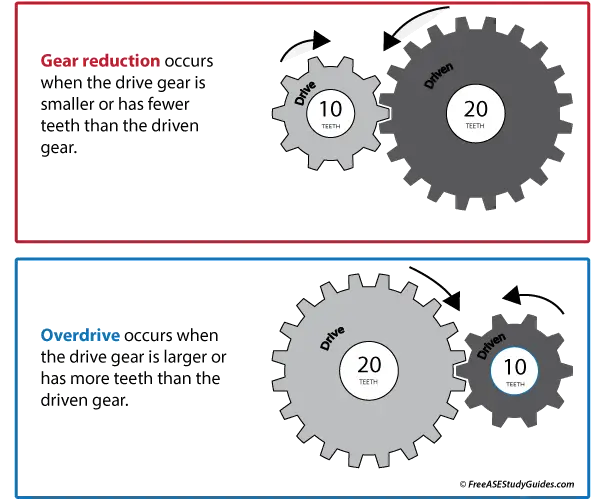

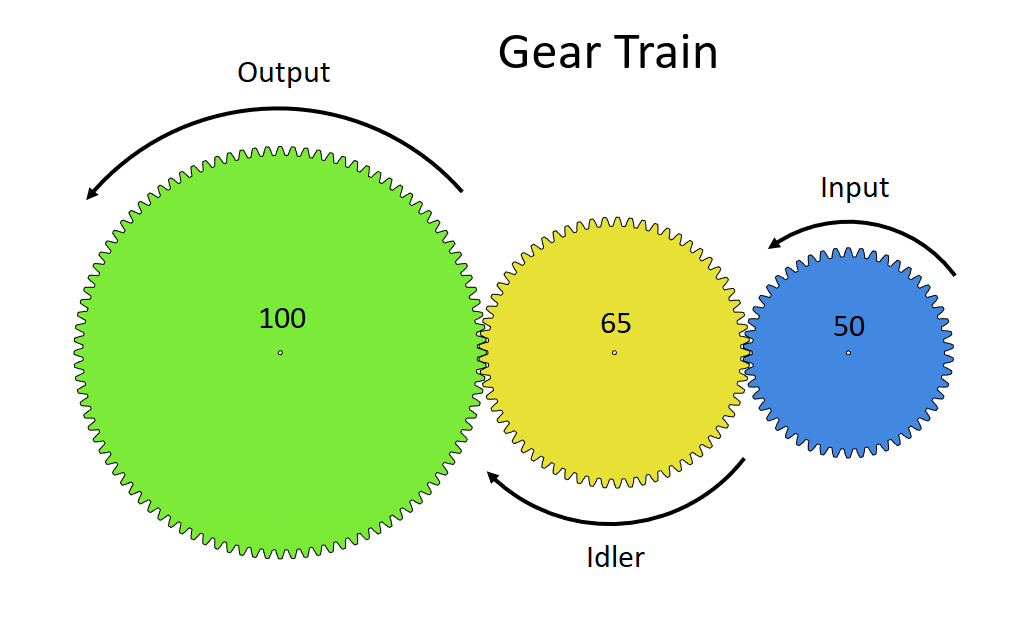

Gear ratio = (input gear teeth number × (gear thickness + teeth spacing)) / (output gear teeth number × (gear thickness + teeth spacing)) but, since the thickness.

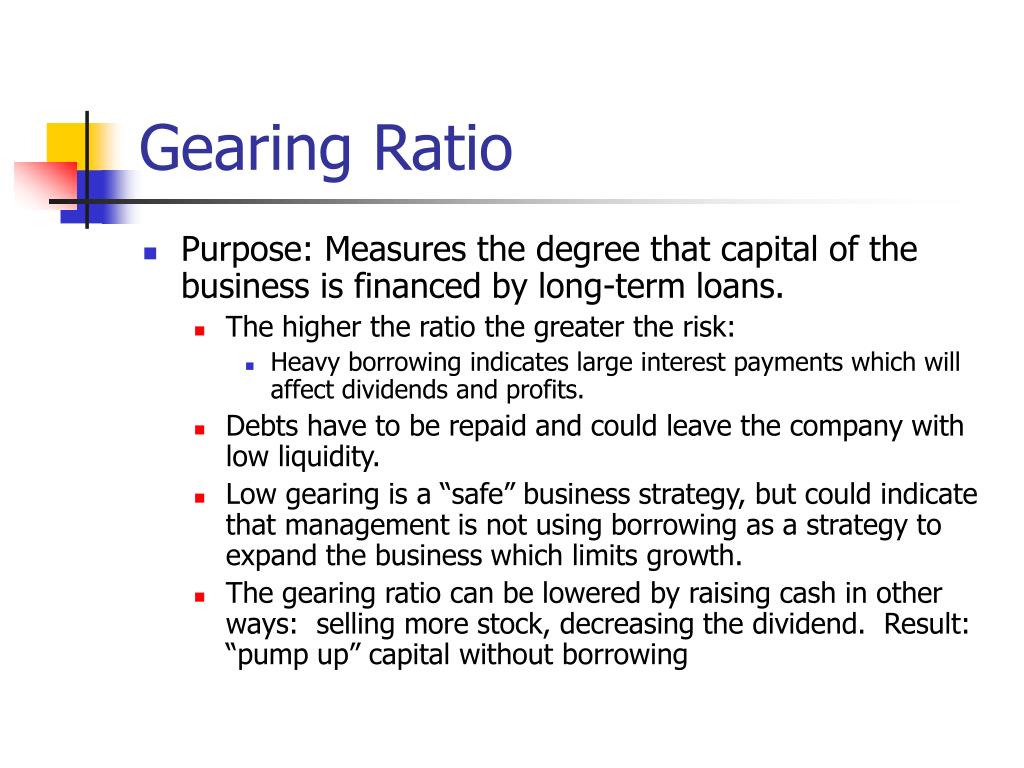

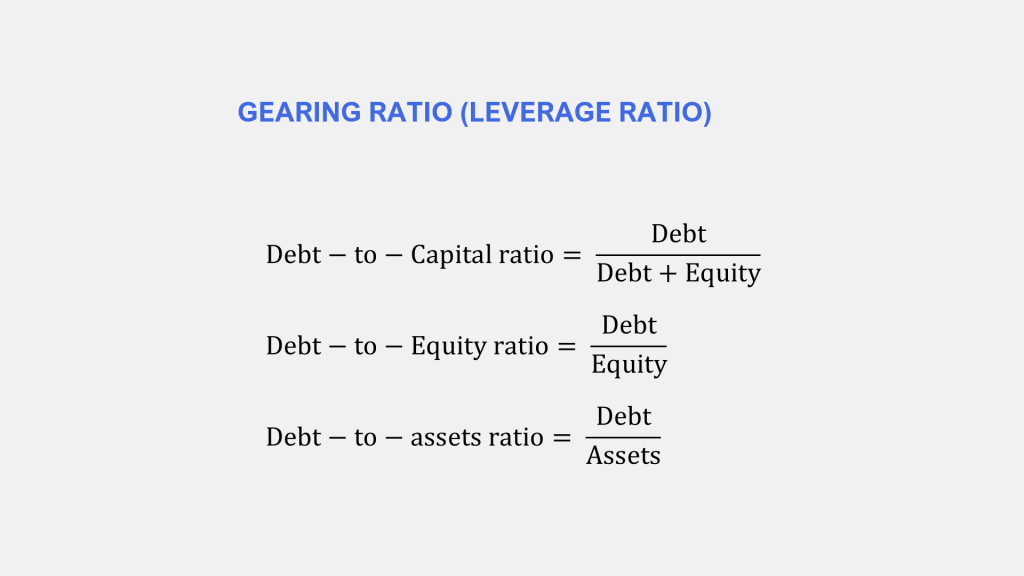

How to reduce gearing ratio. A business with gearing of less. Here are a few of them. A gearing ratio is a useful measure for the financial institutions that issue loans, because it can be used as a guideline for risk.

Written by cfi team what is gearing? When an organisation has more debt, there is a. How to decrease the gearing ratio similarly, there are situations where a company might have to or want to lower the financial gearing which can be done by:

Trading guides hub gearing ratios gearing ratio explained gearing ratios provide an insight into how a company funds its operations, relative to debt and equity. Gearing ratios are important financial metricsbecause they can help investors and analysts understand how much leverage a company has compared to its equity. Hcr gears have two or three teeth in.

How to reduce the gearing ratio. Lendersuse gearing ratios to make important. The primary purpose of the gear ratio is to reduce the torque by increasing the speed, and vice versa.

Your car won’t move at higher gear ratios because, at the. A gearing ratio is a type of financial ratio that compares a company’s debt to other metrics, such as equity or assets; Lenders may consider a business’s gearing ratio when deciding whether to extend it.

The company can also sell its initial public offering or rights issue when it has previously done. We need to calculate the capital gearing ratio and see whether the firm is high geared. To reduce the gearing ratio, companies can pay off debts more quickly.

To reduce the gearing ratio, several solutions are available to business executives. Companies can take steps to pay off their debt and thus, incur less interest long. A company that possesses a.

Put simply, it tells you how much a company's operations are funded by a form of equity versus debt. Gearing ratios are used to get clarity into the. How can the gearing ratio be evaluated?

A business with a gearing ratio of more than 50% is traditionally said to be highly geared. Releasing more shares to the public to increase shareholder equity, which can be used to pay the company’s debt converting loans. Given that the gearing ratio is based on two factors, a company can reduce its ratio by either increasing its equity/capital or reducing its debt.

:max_bytes(150000):strip_icc()/Gearing-Radio-Final-00343e2fb786449ca3ef73daef057c8d.jpg)