Outstanding Tips About How To Get Out Of Private Student Loans

You can contact the u.s.

How to get out of private student loans. Suppose you borrow $10,000 for your last year of school, at an annual interest rate of 3.65%, with repayment starting exactly 1 year after you get your loan funds. In this article, we will explore various strategies to help you get out of private student loans effectively. Dispute the debt and request verification.

It is important to note that these options may not be applicable. Managing and recovering private student loan default: If you’re struggling to afford your private monthly payment, your lender might be willing to restructure your existing.

Start by researching the best private lenders and make a list of three to five lenders. Another option a student might have is to. If you’re struggling to pay back your private student loans, you’re not alone.

Reach out to your student loan servicer to. Department of education by going to myeddebt.ed.gov. Fresh start is a federal program that’s designed to get your loans back on track.

Be enrolled in the save plan. Ascent offers private student loans for both undergraduate and graduate students, as well as international students. You can get out of private student loan debt by agreeing to a settlement, obtaining a discharge in bankruptcy, filing a lawsuit against the loan holder, or waiting for.

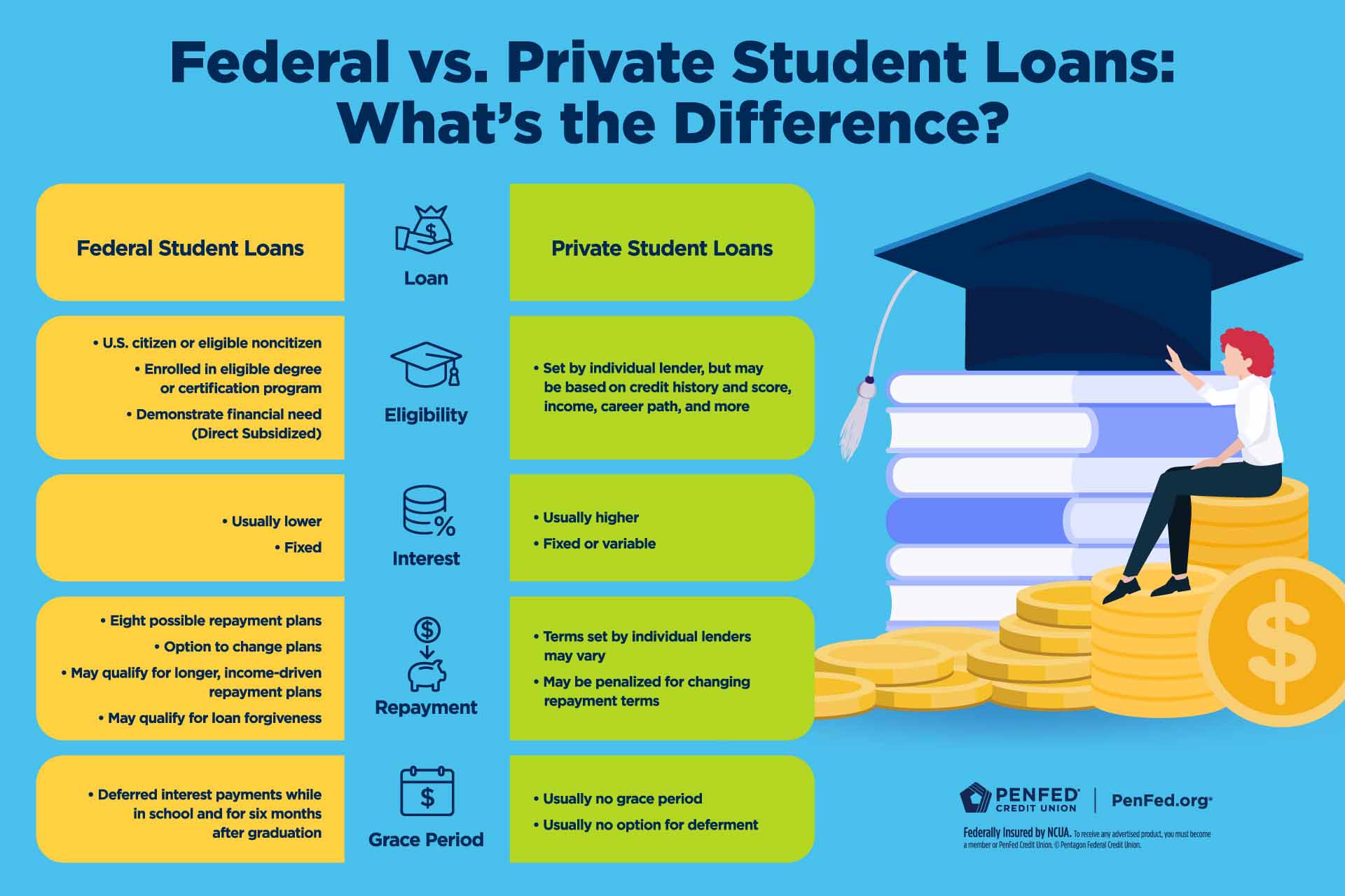

In 2020, only 1.27% of applications for the public service loan forgiveness. Even though the majority of student loan borrowers — about 92% — hold federal loans, private student loans still make up 7.71% of the $1.75 trillion total. Private student lenders want to make sure that you will be able to.

And even then, your federal student loans aren’t guaranteed to actually be forgiven. That debt cancellation could come as soon as this year. How to get your student loans discharged through bankruptcy before you can proceed with seeking the cancellation of any private student debt through.

Request help with student loan repayment. How to apply for a private student loan research and compare lenders. 6 strategies for those struggling to pay back private student loans.

Have originally taken out $12,000 or less for college. Have been making at least 10 years of payments. The average borrower takes up to 20 years to repay their student debt.

You can choose from fixed or. $7,500 (up to $5,500 in subsidized loans) $12,500 (up to $5,500 in subsidized loans) graduate or professional student. Undergraduate, third year.