Sensational Tips About How To Claim Income Tax Back

Why you should file back taxes.

How to claim income tax back. You might be due a refund if you answer ‘yes’ to all of the questions below. Leaving the uk and living or working abroad may refund some of your income tax. You can claim online or use form p85 to tell hmrc that you’ve left or are leaving the uk and want to claim back tax from your uk employment.

If you received a cp237a notice from the irs. Filing back tax returns could help you do one or more of the following: Claiming tax back from uk after leaving 101.

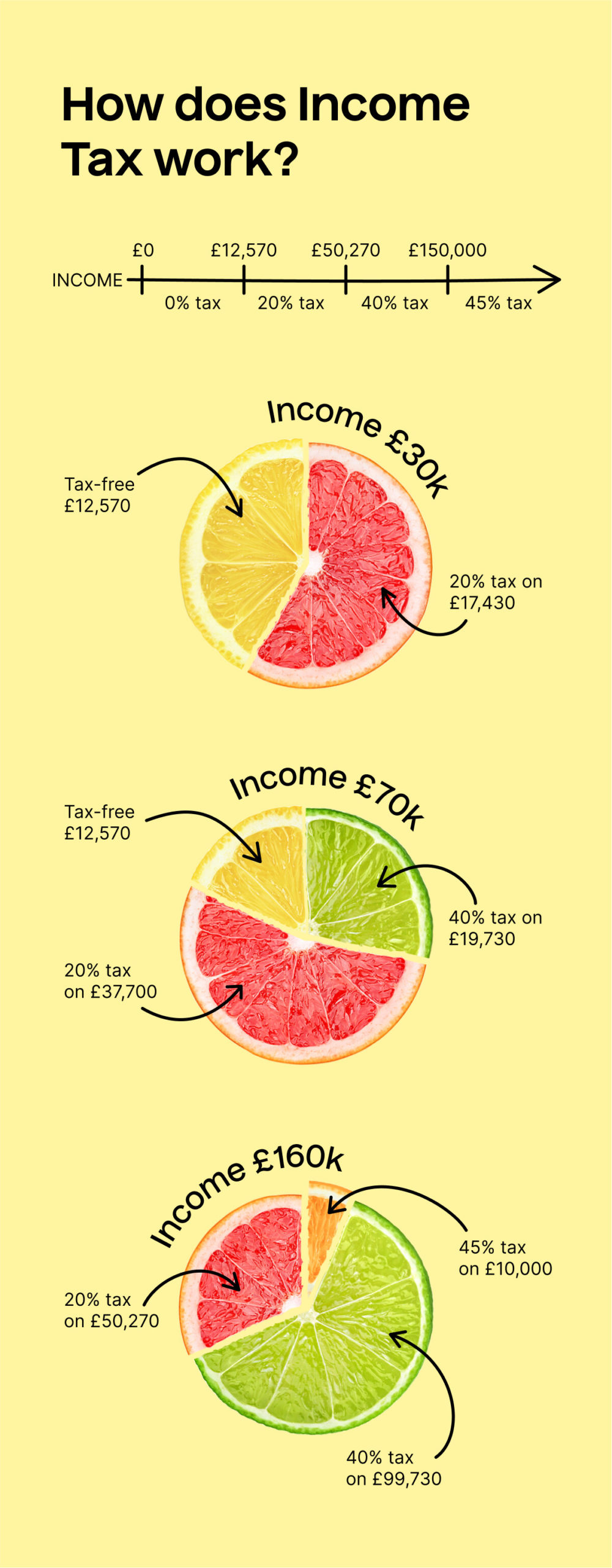

As per the income tax act, a person is required to file his/her income tax return in the relevant assessment year by july 31 (unless the deadline is extended) to. Here is how to claim tax back from hmrc. No one enjoys paying tax but if you overpay you could be left short.

3 years from the date you. You can also use this form to authorise a representative to get. If your 2020 income fell below these limits, you might be able to claim eic by filing by april 15, 2024:

How to file your taxes: The amount a family can receive is up to $2,000 per child, but it's only partially refundable. Job expenses such as working.

Canadians can begin filing their. You may be able to get a tax refund (rebate) if you’ve paid too much tax. And above all, what is an income tax refund?

19 is the first day you can file your taxes online and there are some key changes that will affect the tax filings of many people in canada. How to claim tax refund in malaysia? Within 90 working days after manual submission.

Because many erc refund claims are filed well after the income tax return for the same tax year, the employer in these cases must amend its income tax return to. Taxpayers are also encouraged to read publication 17, your federal income tax (for individuals) for additional guidance. How can you claim it?

It is usually required that you send form p85 to hmrc. The irs will send you a cp237a if the tax refund check they sent you was never deposited. Let’s find answers to all these questions in this article.

What happens to your taxes if you. Step by step check if you need to file gather your documents get credits and deductions file your return get your refund pay taxes on. Learn about unclaimed tax refunds and what to do if your refund is lower than expected.