Breathtaking Tips About How To Build A Cd Ladder

So, with a cd ladder, you don’t have to feel pressured to get the timing perfect like you would if you put the entire savings pot in a single cd.

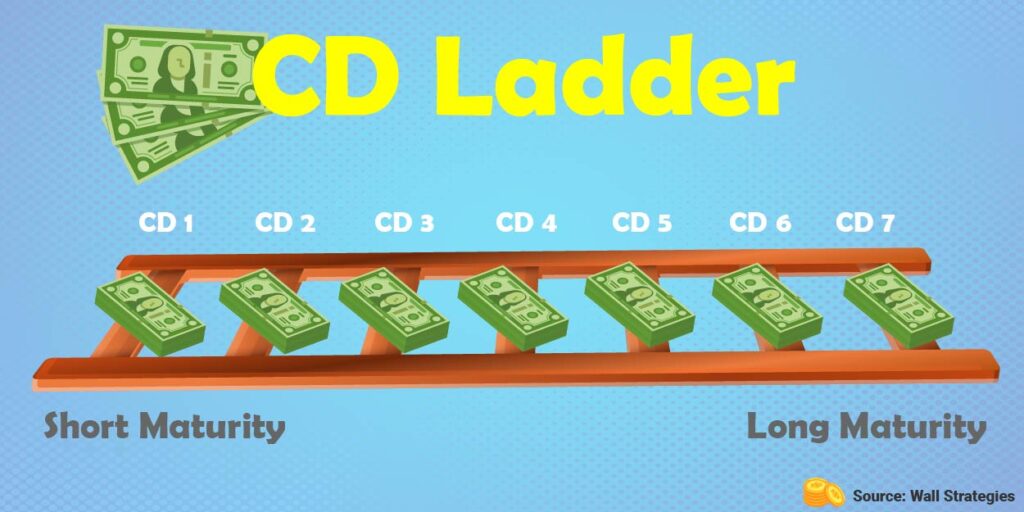

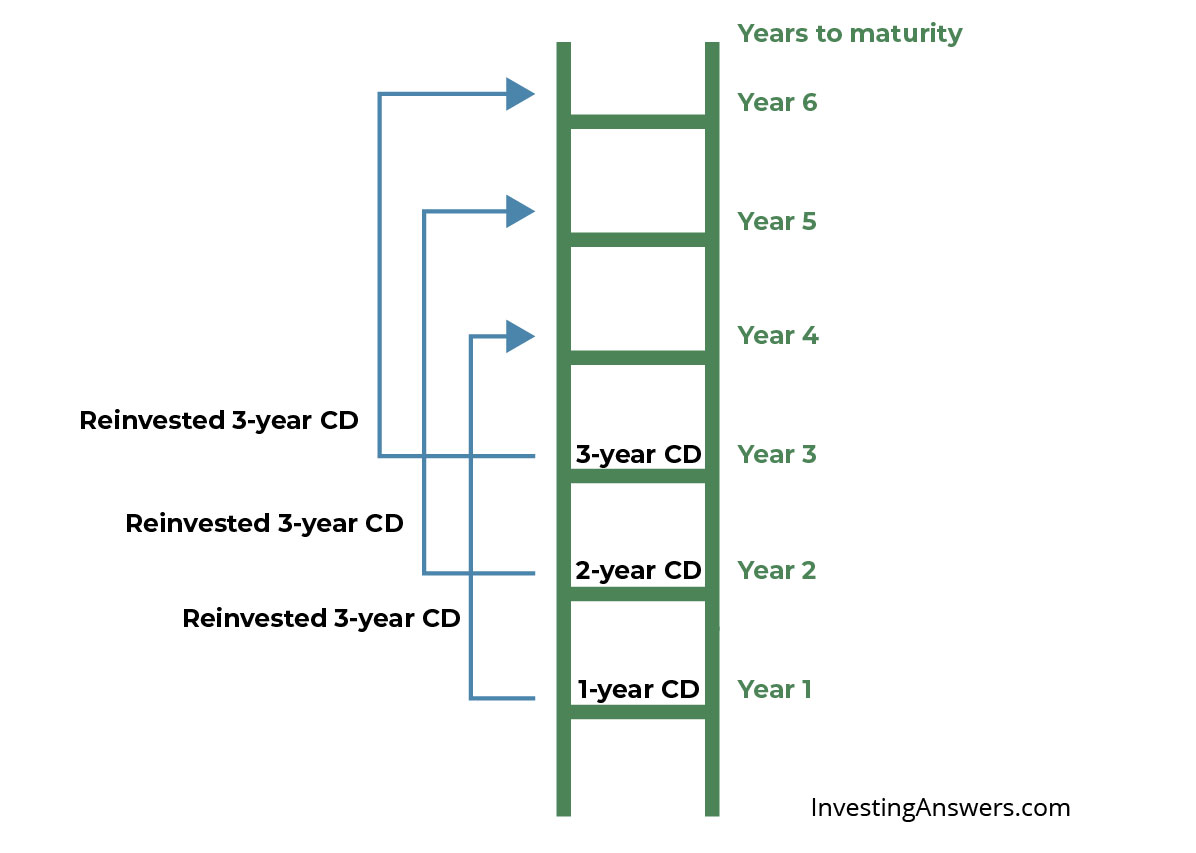

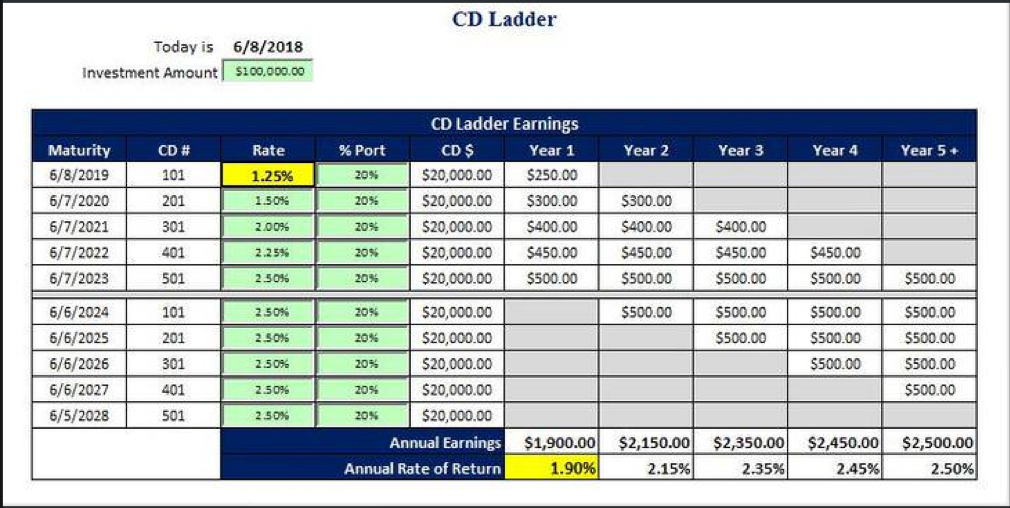

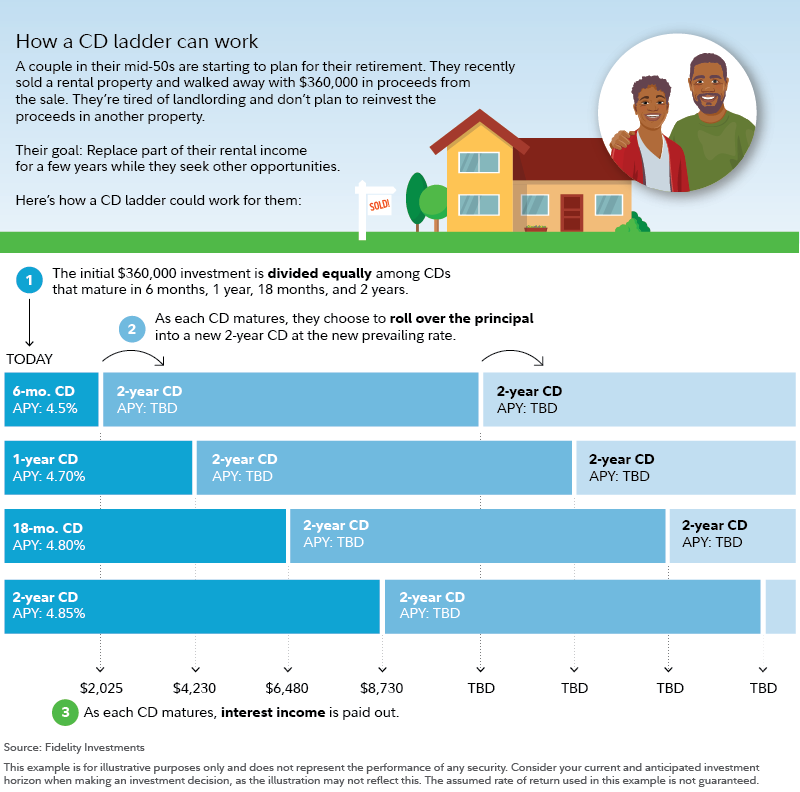

How to build a cd ladder. These rates are the highest 1% average. If you have $2,500 to invest, then you might divide the funds equally into five cds with different maturity dates: Cd laddering refers to a saving and investment strategy where a lump sum of money is divided into multiple certificate of deposits (cds) with different maturity.

One way to keep your money relatively accessible is to build a cd ladder. With the cd ladder approach, you take the amount you have and divide it into five cds. To build a solid cd ladder, anticipate your needs, then build around them.

If you want a cd ladder that offers maturing cds semi annually, it will take a little planning. As each cd matures, you have a choice: How to set up a cd ladder.

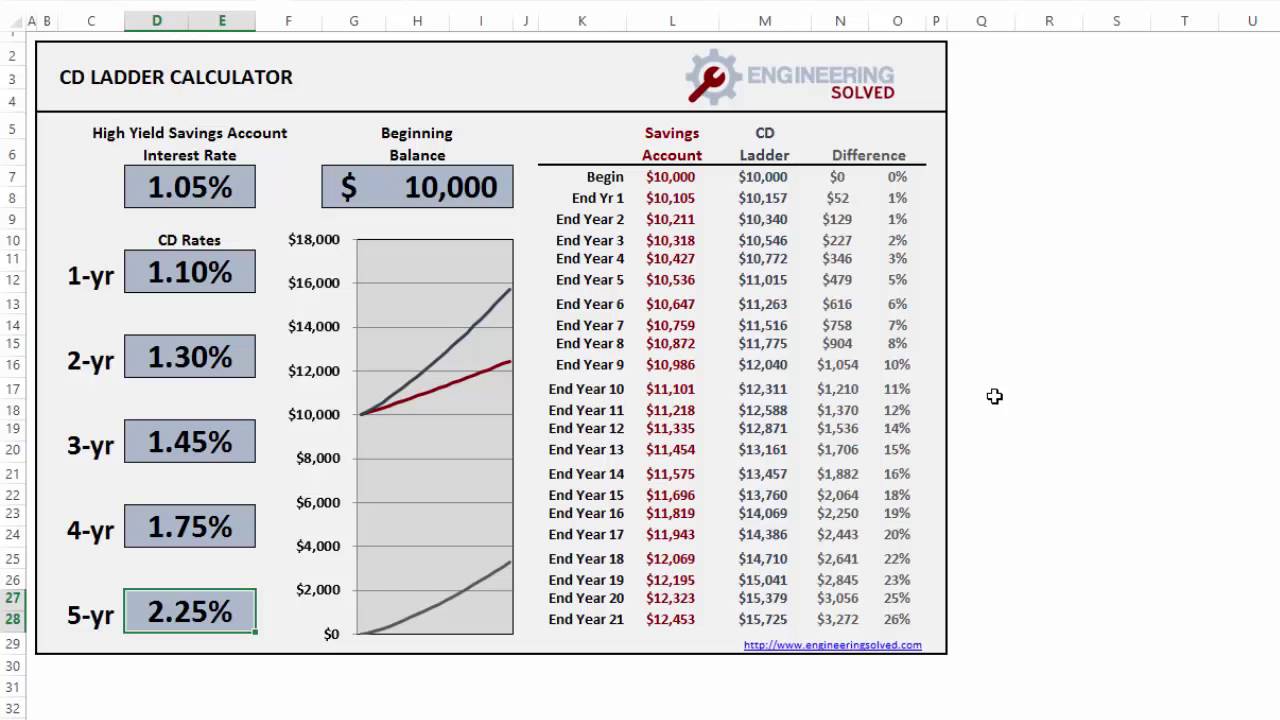

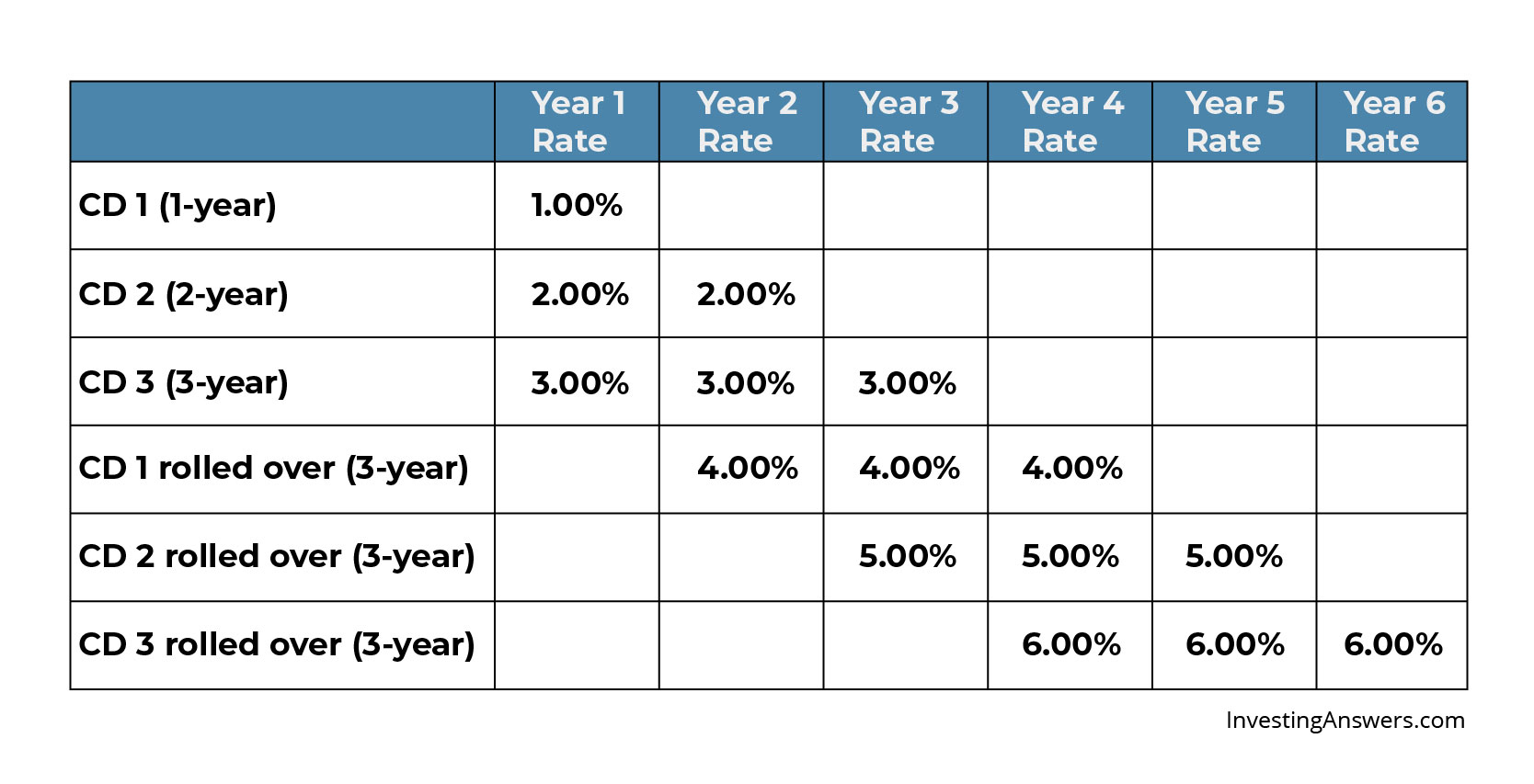

A cd ladder involves dividing your investment — usually evenly — into several cds of different term lengths with staggered maturity. Use the ladder tool to create your own cd or treasury ladder. Determine your why for building a cd ladder.

How to build your cd ladder. How to build a semi annual cd ladder. We'll use $5,000 for this example.

Butler says building a cd ladder might be ideal if you find a competitive rate and are generally. How to build a cd ladder. Learn how to use a ladder strategy to provide current income while minimizing exposure to interest rate fluctuations.

A cd ladder offers benefits that a long term cd does not. If the idea of low risk combined with a fixed return sounds appealing, a cd ladder might be for you. You can take advantage of.

Below, we outline how to create a cd ladder for cash flow and a cd ladder for mid term savings goals. And that’s where a cd ladder comes in. At the end of the first year, the 1.